Introduction

Not a day passes without claims being made by experts, analysts and organizations prominent among them the International Energy Agency (IEA) about climate change, global energy transition, net-zero emissions, peak oil demand and the end of oil.

However, the global economy can neither take such claims nor can it fulfil them. And contrary to these claims, oil will continue to drive the global economy throughout the 21st century and probably far beyond underpinned by both rising world population and growing global economy.

There could neither be a global economy nor a modern civilization as the one we know and enjoy without oil. How could the world feed a growing population projected to rise from 7.9 billion today to 9.7 billion by 2050 and a global economy projected to grow in size from $91 trillion in 2021 to $245 trillion also by 2050 without oil. 1

Whilst some claims about climate change are credible enough with rising sea levels, wild-fires, heatwaves and extreme weather events already wreaking havoc everywhere and costing the global economy a staggering $1 trillion dollars over the next five years in crumbling infrastructure, reduced crop yields, health problems, and lost labour, others are either unsubstantiated or controversial. 2

Environmentalists who call for an abrupt end to fossil fuels and a sudden adoption of renewable energy fail to recognize the obvious lack of logic in this. On their own, renewables aren’t capable of satisfying global demand for electricity and energy because of their intermittent nature.

While the process of global energy transition will continue to move forward, a total energy transition is an illusion. Even a partial one will never succeed without huge contributions from natural gas and nuclear energy. 3

The notion of net-zero emissions is a myth. It will never be achieved in 2050 or 2100 or ever. In fact, the percentage of fossil fuels in the world’s energy mix—coal, oil and natural gas—is still lingering well above 80%, a figure that has changed little in 30 years. 4 That remains the case despite being challenged by serious environmental policies and despite a global expenditure of $ 3.0 trillion on renewable energy during the last decade. This is a hefty price to pay just to gain only a percentage point of market share from coal. 5

Therefore, the best way to combat climate change is for the global oil industry to focus on reducing carbon emissions from fossil fuels and not their actual use.

Of recent times various claims were made about peak oil demand. This topic has become one of the most contentious and fascinating debates in the oil industry over the past few years with forecasts for the pending peak seemingly creeping closer to the present with every new publication. The precise dates vary from late 2020s to 2040’s. While an increasing number of electric vehicles (EVs) on the roads coupled with government environmental legislations could slightly decelerate the rate of demand growth for oil, EVs could never replace oil in global transport throughout the 21st century and far beyond.

Moreover, talk about weaning all airlines off fossil fuels by 2050 is a pie in the sky. Biofuel, electric and hydrogen planes are all non-starters. Biofuel planes will deprive a world facing the threat of food shortages in the very near future of agricultural land that is better used to bolster food production and feed a population projected to grow to 9.7 billion by 2050. A blending of aviation fuel with a small percentage of biofuels might prove a better alternative. Still, it will only lead to a minuscule reduction in global CO2 emissions. Moreover, the theory that we end up with zero emissions when burning organic matter because the carbon produced must have been absorbed while the organic matter was growing wouldn’t stand scrutiny. 6

Electric planes aren’t going to fare better than EVs. Moreover, carrying a number of very large and heavy batteries on board is neither practical nor safe. Furthermore, the emissions from making and de-commissioning lithium batteries are estimated to match if not exceed those from jet fuel. 7

Whether green, blue or grey, hydrogen is a non-starter. Moreover, it needs far more energy to produce than it will eventually provide. Furthermore, the safety factors alone will be a real drag on the practicability of hydrogen planes. 8

In the final analysis, the most efficient way to reduce emissions from the aviation industry is continuing fuel efficiency. So the claim that it may become possible in the future to fly emissions-free will remain a myth maybe for ever.

There could never be a post-oil era throughout the 21st century and probably far beyond. It is very doubtful that an alternative as versatile and practicable as oil, particularly in transport, could totally replace oil in the next 100 years and beyond. What will change is some aspects of the multi-uses of oil in electricity generation and water desalination which will eventually be mostly powered by solar and nuclear energy. 9

Oil and gas will continue to be the core business of the global oil industry well into the future. While the oil industry is investing huge amounts in renewables, such investment pales in size when compared with that in oil and gas. The slower pace of oil majors toward alternative energies is due to two key reasons. The first is that they all believe that oil and gas will continue to be needed well into the foreseeable future. And the second reason is that financial returns from renewables are nothing compared to those for oil and gas.

Therefore, humanity has two choices. One is to accept at face value climate alarmism and the misleading information about the imminent existential threat of climate change that the environmental activists have been propagating over the past three decades, threats that may or may not happen and the other is ditching fossil fuels and see a collapse of the global economy resulting in starvation, plagues and nuclear wars with major powers trying to grab available energy resources and the eventual demise of humanity. I am sure that the overwhelming mass of humanity would accept even a high level of emissions and global warming rather than immediate death.

The Last Oil Barrel?

If oil and gas will continue to drive the global economy well into the future, then where will the last barrels of oil come from?

In my opinion, these barrels will come from the Arab world, Venezuela and Russia with the very last barrel produced most probably coming from Iraq.

(i)- Iraq

Iraq sits on the world’s largest oil reserves estimated to exceed 400 billion barrels (bb) of oil between proven and semi-proven reserves according to international experts who assessed Iraq’s oil potential. 10 Moreover, Iraq has the cheapest production costs in the world estimated at $2-$3 a barrel. Furthermore, only 70% of Iraq’s territory has been explored for oil.

Iraq’s oil potential is still underestimated, partly because the current assessment is based on a recovery rate much less than 20% and probably lower than 15% of its oil-in-place (OIP). This compares with a global average of 34%-35% and also with rates above 45% in the United States, UK, Canada and Norway. Iraq has never implemented advanced technologies, like 3-D exploration techniques, or deep and horizontal drilling and hydraulic fracturing, to find or tap new wells.11

Despite its long history as a producer, Iraq is largely untapped as far as oil development is concerned, according to the assessment made by the International Oil Companies’ (IOC’s) who were awarded re-development contracts between 2009 and 2011. Since production began at the dawn of the twentieth century, only 2,300 wells (both for exploration and production) have been drilled there, compared with about one million in Texas. A large part of the country, the western desert area, is still mainly unexplored. 12

Of more than eighty oilfields discovered in the country, only about twenty-one have been partially developed. Given this state of underdevelopment, it is realistic to assume that Iraq has far larger oil reserves than documented so far, probably about 200 billion barrels (bb) more. These numbers make Iraq the fulcrum of any future equilibrium in the global oil market. 13

Based on its potential, Iraq could be expected to supply the global oil market with 12-13 million barrels a day (mbd) in the next two decade and will most probably be producing the very last oil barrel in the world.

(ii)- Venezuela

The second barrel before the last will probably come from Venezuela which currently has the world’s largest proven reserves estimated at 303.8 bb. 14 Venezuela alone accounts for 92% of Latin America’s proven oil reserves.

While both Venezuela’s economy and oil industry are currently in shambolic state, they will rebound quickly when the world realizes how dependent on Venezuela’s oil it will be in coming years.

The late Canadian Prime Minister Pierre Trudeau was once quoted saying about the United States that “living next to you is in some ways like sleeping with an elephant. No matter how friendly and even-tempered is the beast, if I can call it that, one is affected by every twitch and grunt”. For Venezuela, sitting on the world’s largest proven oil reserves next to the world’s largest consumer of oil must be a cause of worry. No matter how Venezuela’s neighbour is good and neighbourly, it must still cast some envious eyes on such unbelievably huge oil wealth.

(iii)-Russia

The third barrel will come from Russia’s Arctic region. It is estimated that the Arctic contains 13% of the earth’s oil reserves and a quarter of its untapped gas reserves. Russia’s untapped and inexhaustible reserves of oil and gas at the Arctic are estimated at 125 bb of oil and 3004-3534 trillion cubic feet (tcf) of gas. If these are added to Russia’s current proven reserves of oil and gas, the figures then mushroom to 233 bb of oil and 4324-4854 tcf lasting from 1-2 centuries. Thanks to the Arctic, Russia will maintain its position as the world’s energy superpower throughout the 21st century. Russia’s oil and natural gas reserves will last for more than a century according to Russia’s gas giant Gazprom. 15

Russia seems intent on selling the world’s very last barrel of oil. As other energy supermajors and petro-states around the world scramble to diversify their economies and establish a foothold in the burgeoning green energy transition, Russia has stalwartly refused to ease its reliance on its fossil fuels industry and is vying for the distinction of being the last man standing in the global oil industry. It’s more than probable that the world still has an appetite for hundreds of billions of barrels of oil, and Russia will be more than happy to supply them.16

The Arctic is, in my opinion, Russia’s ‘Wild West’ to borrow a phrase from America’s history. President Putin has long ago recognized the great importance of the Arctic for the Russian economy and the Russian oil industry. That is why he has been pouring hundreds of billions of dollars into the region.

The Changing Balance of Power in the Global Oil Market

The power structure of global oil markets is already undergoing a major transformation exemplified by the rising power of the National Oil Companies (NOCs) and the declining influence and power of International Oil Companies (IOCs). In coming years, this power structure is set for a major shakeup if the reserve lifespan of IOCs continues to decline.

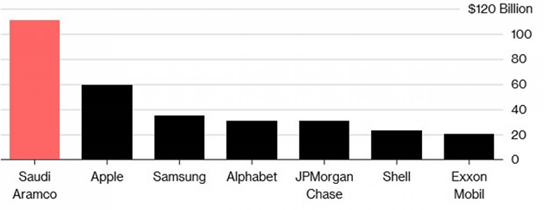

This shift could be evidenced from a comparison of Saudi Aramco’s net income in 2018 with ExxonMobil and Shell. Saudi Aramco’s net income of $111 bn was almost 6 times that of ExxonMobil ($20.8 billion) or Shell ($23.4 billion) (see Chart 1).

Chart 1

Net Income in 2018

Source: Oilprice.com accessed on 8 April, 2019

Whilst top IOCs such as Total, BP, Shell, Chevron, ENI, ConocoPhillips, ExxonMobil, Equinore and Repsol have reserve estimated to last from 8.0-10.5 years, the NOCs of countries like Saudi Arabia, Iraq, UAE, Venezuela, Russia and Kuwait to name but a few have access to proven reserves which could last from 66-91 years at the 2019 production levels. 17

Between 1998 and 2002, top IOCs replaced 99.7% of oil produced. This declined to 51.7% between 2003 and 2007. Overall average IOCs’ reserves in place have fallen by 25% since 2015 with less than 10 years of total annual production available. For instance, oil supermajor Shell expects to have produced 75% of its current proven oil and gas reserves by 2030, and only around 3% after 2040. 18

This transformation has been inevitable since the birth of OPEC just over sixty years ago. The formation of OPEC marked a turning point toward national sovereignty over natural resources and OPEC decisions have come to play a prominent role in the global oil market and international relations.

High oil prices have enhanced the bargaining power of oil-exporting countries. As a result, major IOCs have struggled to secure access to new oil reserves and their production has dropped in recent years.

Resource nationalism has been on the rise around the world underpinned by governments wanting to fully control whatever hydrocarbons and mineral resources they have in order to maximize their revenues, growing global demand for these resources and also growing influence of the NOCs. That is why resource nationalism has become a major threat for the IOCs.

As a result of resource nationalism, IOCs are not welcome in the major oil-producing regions of the world, the Middle East, North Africa and much of Latin America. These regions in which IOCs most want to operate, are becoming extremely difficult operating environments due to political and regulatory constraints. Much of the major IOCs’ production comes nowadays from the North Slope in Alaska, the Gulf of Mexico and the North Sea, areas which are witnessing rapid decline and where production is becoming increasingly more expensive. North America and the North Sea account for an estimated 60% of the IOCs’ oil.

Profit margins per barrel are also a major investment issue as IOCs have been looking at the more challenging environments, such as deepwater, offshore, Arctic, or shale, while NOCs still have major conventional reserves in place.

Some analysts claim that the current reserve crisis is no real issue, as most IOCs are going through an energy-transition phase. However, to invest in the energy transition these companies need plenty of cash to cope with the planned multi-billion-dollar wind, solar, and hydrogen projects, while also keeping investors and shareholders happy. Almost 80% of this cash flow is generated from oil and gas. As one chairman of an IOC put it succinctly “Black pays for Green”.

Major IOCs have been earning an estimated 20% return on investment, a healthy figure by industry standards. Without doubt, high oil prices have enabled them to generate unprecedented profits but they have also fuelled a resurgence of resource nationalism, which along with increased industry competition severely limited areas open to IOC investment. It is becoming increasingly difficult for IOCs to find attractive ways to reinvest their profits and it will not get easier given that there are limited drilling prospects.

The largest and the cheapest oil reserves to produce are located in the Arab Gulf region and Russia and not in the hands of the IOCs. Instead, they are controlled by NOCs and governments who can self-finance the whole operation from reserves to pipelines.

Conclusions

Despite incessant efforts by environmental activists and divestment campaigners to keep oil underground, Oil will continue to drive the global economy throughout the 21st century and probably far beyond.

It is possible that one sinister reason behind the calls for global energy transition and keeping oil underground is to prevent the Arab world and Russia from enhancing their geopolitical and economic influence over the global economy in coming years with the continued use of oil.

Still, last barrels of oil will come from the Arab world, Venezuela and Russia with the very last barrel produced most probably coming from Iraq.

Footnotes

- Data from the World Bank & the IMF accessed on 15 November 2021.

- “Is It Possible to Have a Nuanced Discussion about the Energy Transition?” posted by oilprice.com on 23 May 2021 and accessed on 23 May 2021.

- Mamdouh G Salameh, “The Truths & Myths about Global Energy Transition”, the International Association for Energy Economics (IAEE), Fourth Quarter 2021.

- “EU Admits It Can’t Go Net-Zero without Natural Gas”, posted by Oilprice.com 26 April 2021 and accessed on 26 April 2021.

- Mamdouh G Salameh, “A Mandatory Energy Transition Wouldn’t Work” IAEE Energy Forum / Second Quarter 2020, p. 25.

- “Biden Administration Wants to Wean All Airlines Off Fossil Fuels by

- Ibid.,

- Ibid.,

- Mamdouh G Salameh, “A Post-Oil Era Is a Myth”, USAEE Working Paper Series No:16-290, 8 December 2016.

- Mamdouh G Salameh, “Over a Barrel”. Joseph Raidy Printing Press sal, Beirut, Lebanon p.194.

- Mamdouh G Salameh, “Iraq: An Oil Giant Constrained by Infrastructure & Geopolitics” USAEE Working Paper Series No: 13-151, 25 December 2013.

- Ibid.,

- Leonardo Maugeri, “Oil: The Next Revolution”, a report published by Belfer Center for Science & International Affairs at Harvard Kennedy School, June 2012, pp.11-12.

- BP Statistical Review of World Energy, June 2021, p.16.

- “Gazprom: Russia has Gas Reserves for More than a Century” posted by oilprice.com on 17 September 2021 and accessed on 17 September 2021.

- “Russia Has Big Plans for Arctic Oil” posted by oilprice.com on 12August 2021 and accessed on 12 August 2021.

- Mamdouh G Salameh, “The Battle for Reserves & Dominance between IOCs & NOCs: Wo Will Prevail?” an article posted by the Hellenic Association for Energy Economics (HAEE) on 26 April 2021.

- Ibid.

-----------------------------------------------------------------------------------------------------------------------------

*Dr. Mamdouh G. Salameh is an international oil economist. He is one of the world’s leading experts on oil.

He is also a visiting professor of energy economics at ESCP Business School in London.

Disclaimer: "The contents of this article are the author's sole responsibility. They do not necessarily represent the views of the Hellenic Association for Energy Economics or any of its Members".