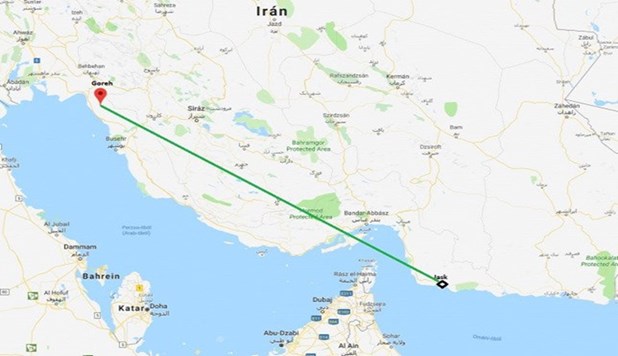

The Iranian Goreh-Jask oil pipeline isn’t yet a household name but soon it will be for two major reasons when it is completed by the end of March 2021. The first reason is that it will allow Iranian crude oil exports to bypass the Strait of Hormuz for the first time since oil production started in Iran in the early twentieth century. The second reason is that it will enhance Iran’s geopolitical influence immeasurably by allowing it to be able to use the threat of closing the Strait of Hormuz for political reasons without hindering its own oil exports (see Map 1).

Map 1: The Goreh-Jask Oil Pipeline

At present, nearly 19 million barrels a day (mbd) of oil traffic, a fifth of the global oil trade and a third of global LNG supplies, pass every day through the Strait of Hormuz, the most vital chokepoint in the world. At its narrowest point, the Strait is only 21 miles wide.

Oil exports from Iraq, Iran, Kuwait, Bahrain, Qatar (including large volumes of LNG exports), the UAE and Saudi Arabia must pass through the Strait. At present, Iran has no other route to export its crude oil.

The U.S. Fifth Fleet patrols the area because of its strategic importance. Iran has threatened to disrupt oil traffic through the Strait if its crude oil exports were

Blocked or prevented from crossing the Strait on their way to world markets.

Game-changing Iranian Oil Pipeline to Bypass Hormuz

To address that element of security, Iran started in 2019 building a $1.8 billion oil pipeline that will connect its huge oil fields cluster at Goreh in the West Karoun region to the Jask port terminal at Hormozgan Province on the Gulf of Oman (see Map 2).

Map 2: The Jask Oil Terminal on the Gulf of Oman

After the completion of this first phase of offshore pipeline laying, the Goreh-Jask pipeline will begin full pumping tests aimed at ascertaining its capacity to transfer initially 350,000 barrels a day (b/d) of crude oil through the 1,100 km-long pipeline to its port of Jask outside the mouth of the Gulf on the Gulf of Oman.

Tehran has threatened to block the vital Gulf oil shipping route during its standoff with the United States, after Washington withdrew from Iran’s 2015 Iran nuclear deal and re-imposed sanctions on Tehran’s vital oil exports.

The geopolitically game-changing Goreh-Jask pipeline saw a major advance last week with the commencement of offshore pipe-laying operations. The implementation of this operation marks the first stage of the offshore development of the Jask oil terminal. Overall, the terminal is 70% complete, allowing the project to come online by late March.

The oil will then be stored once it has arrived in Jask in one of the 20 storage tanks each capable of storing 500,000 barrels of oil in the first phase (totalling 10 million barrels) for later loading on to very large crude carriers (VLCCs) headed from the Gulf of Oman and into the Arabian Sea and then on to the Indian Ocean. The second phase will see an expansion to an overall storage capacity of 30 million barrels. The development of Jask is very important and strategic at the national level. In addition to the construction of the terminal, a refinery and a petrochemical plant will also be built at the port.

Around 90% of all of Iran’s oil for export is currently loaded at Kharg Island – with most of the remaining loads going through terminals on Lavan and Sirri islands making it an obvious and easy target for the U.S. and its proxies to cripple Iran’s oil sector and therefore its economy (see Map 3).

Map 3: The Kharg Island Oil Loading Terminal

Even before U.S. sanctions were re-imposed in May 2018, the Kharg terminal was not ideal for use by tankers as the narrowness of the Strait of Hormuz means that they have to travel extremely slowly through it thus making them easy targets for even simple attacks.

Additionally positive for Iran is that having a huge oil storage capacity available just a short direct sea journey away from Pakistan and then on into China is likely to result in the final go-ahead for the construction of the Iran-Pakistan oil and gas pipeline, and then put further pressure on the developing India-UAE-U.S. relationship as India may well think that resuscitating the Iran-Pakistan-India pipeline is preferable to the current plans with the UAE.

Iran Perfecting the Art of Evading US sanctions

With sanctions on Iran still in place following the US’s unilateral withdrawal from the Joint Comprehensive Plan of Action (JCPOA) in May 2018, Tehran has been relying on the tried-and-tested sanction-busting measures to continue to export increasing volumes of crude oil. These measures include the re-labelling of Iranian oil into Iraqi oil on the border and at the shared oil reservoirs of the two allies, the use of international brokers to hide Iranian oil movements, ship-to-ship transfers of Iranian oil in the territorial waters of Malaysia, Indonesia, and China, and the amalgamation of Iranian oil in Iraq’s oil pipeline export routes.

Moreover, the ability to add yet another dimension to Iran’s current playbook of sanction-busting activity will be in line with the supportive views of senior Iranian politicians for these activities. Back in December 2018 at the Doha Forum, Iran’s Foreign Minister, Mohammad Zarif, stated that: “If there is an art that we have perfected in Iran that we can teach to others for a price, it is the art of evading sanctions.” And within just the last couple of weeks, Iran’s Petroleum Minister himself, Bijan Zangeneh, added a little detail to one such tried-and-trusted methods: “What we export is not under Iran’s name. The documents are changed over and over, as well as the specifications.”

Will US sanctions Be Lifted under a Biden Administration?

President Biden said during the presidential elections that he is prepared to re-join the Iran nuclear deal if Iran returns to strict compliance - but he wouldn't lift sanctions until then. He added that Trump’s "maximum pressure" policy has failed while Iran is now closer to a nuclear weapon than it was when Trump came to office.

Iran has made it clear that that it will neither agree to any limits on its nuclear and ballistic missile development programmes nor will it negotiate with President Biden without a lifting of US sanctions first or at least a significant easing of them. This is something President-elect Biden will find difficult to accept and therein lies the rub.

Moreover, Biden will come under intensive pressure from Israel and US allies in the Arab Gulf not to re-join the nuclear deal or lift the sanctions. Whether under Trump or Biden or any other US president, Israel comes first in US strategic calculations even ahead of US own interests. So nobody should, therefore, bank on a lifting or even easing sanctions on Iran soon.

On the other hand, one has to consider the unthinkable eventuality that Iran might be happy by the level of success it has achieved so far in nullifying and evading the sanctions. It might even think that the sanctions are a small price to pay for forcing the ejection of US military presence from Iraq and making Iraq a vassal of Iran thus achieving a spectacular geopolitical victory over the United States.

-------------------------------------------------------------------------------------------------------------------------------------------

*Dr. Mamdouh G. Salameh is an international oil economist. He is one of the world’s leading experts on oil.

He is also a visiting professor of energy economics at ESCP Business School in London.

Disclaimer: "The contents of this article are the author's sole responsibility. They do not necessarily represent the views of the Hellenic Association for Energy Economics or any of its Members".